Gold Falls 4% Sharply As Virus Fears Drive Investors Towards Cash

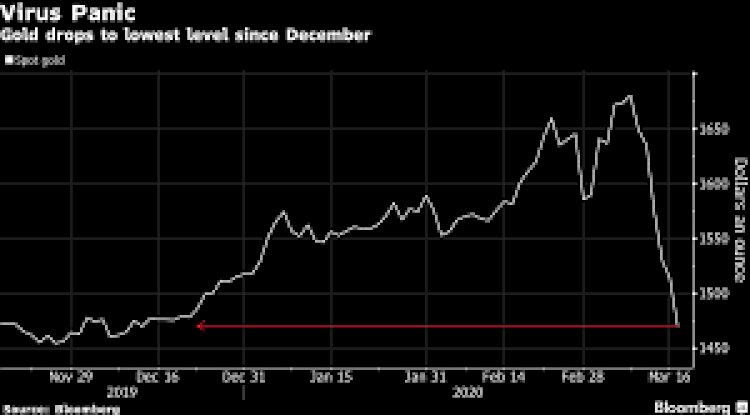

Gold dropped 4% on Tuesday as investors dumped precious metals in favour of cash after additional stimulus measures by the United States failed to calm markets hit by mounting fears over the economic downside from the coronavirus. Sellers ‘sell what they can’ amid intensifying coronavirus fears.

By Pallabi Ghatak

Gold Rate Today (Tuesday, August 12, 2020): At 10:12 am, the MCX gold futures contract quoted at Rs 50,293, down Rs 1,636 - or 3.15 percent - from its previous close.

Market liquidity "in a panicky global marketplace is drying up as traders and investors back away from the trading market. "When in doubt, get out" is the mantra today. Gold prices tumbled nearly 4% on Tuesday as US yields shot higher following a larger than expected US PPI index. The dollar moved lower which helped gold prices from falling further. The US 10-year yield increased by 6-basis points, closing near the highest levels seen in the past few months near 64-basis points.

Gold and silver prices suffered strong losses in early deals in the domestic futures market on August 12 as per reports of coronavirus vaccine, strength in the dollar index and better than expected US PPI and core PPI numbers pushed both the precious metals lower.

GOLD PRICE IN INDIA: On Wednesday domestic gold futures fell nearly 4 percent to briefly below the Rs. 50,000, as when the global rate slid below $1,900 per ounce. Multi Commodity Exchange (MCX) gold futures - due for an October 5 delivery - dropped by as much as Rs 1,974 - or 3.80 percent - to Rs. 49,955 in morning deals. At 10:12 am, the MCX gold futures contract quoted at Rs 50,293, down Rs 1,636 - or 3.15 per cent - from its previous close.

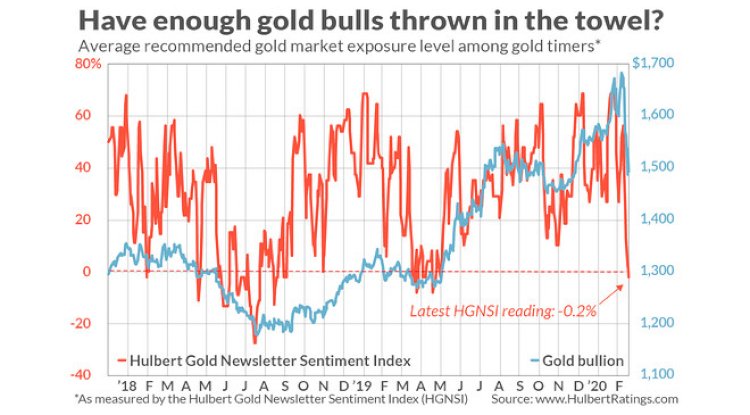

INTERNATIONAL MARKET: Spot gold was down 1.9% to $1,499.59 per ounce by 10:59 am EDT (14:59 GMT). US gold futures were down 1.6% to $1,501.10. "Gold continues to suffer from risk-off panics in the market, trading back below $1,500 level as S&P futures gave up stimulus-driven gains," said Tai Wong, head of the base and precious metals derivatives trading at BMO.

TECHNICAL ANALYSIS: Gold prices tumbled after rallying 6% over the past two weeks. Prices sliced through short-term support, near the 10-day moving average, which is now seen as resistance at 2,001. Target support is seen near the 50-day moving average at 1,825. Short-term momentum has turned negative as the fast stochastic generated a crossover sell signal. The current reading on the fast stochastic is 68. The move from overbought to neutral reflects accelerating negative momentum. Medium-term momentum has turned negative as the MACD (moving average convergence divergence) index generated a crossover sell signal. This occurs as the MACD line (the 12-day moving average minus the 26-day moving average) crosses above the MACD signal line (the 9-day moving average of the MACD line).

WHOLESALE PRICES RISE: The Labor Department reported that the producer price index increased 0.6%, driven by a surge in gasoline. This was the biggest gain since October 2018 and followed a 0.2% decline in June. On a year over year basis, the PPI dropped 0.4% after falling 0.8% in the 12 months through June. Expectations were for PPI to rise by 0.3% in July. Excluding the volatile food, producer prices increased 0.3% last month after a similar rise in June. On a year over year basis, core PPI edged up 0.1%.

Experts point out that it is the right time for profit-booking in gold and silver and traders should have a cautious approach while taking any position in bullion on these higher levels. "Approval for the first Covid-19 vaccine by Russia's health ministry has put pressure on the bullion. Traders may book profit on higher levels and may go for a sale in gold and silver. However, global economic instability and geopolitical tension between the US and China may work as a supportive factor for bullion in the long run," said Anuj Gupta, DVP - Commodities and Currencies Research, Angel Broking.

What's Your Reaction?