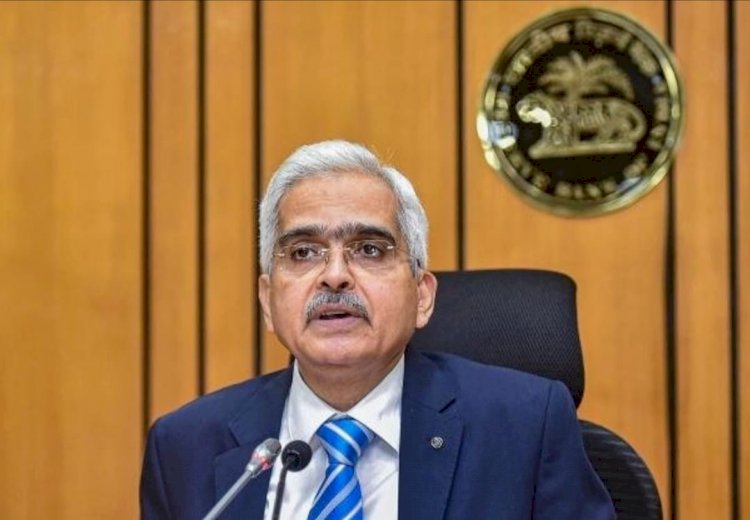

India’s GDP To Start Its Journey Towards Contraction, RBI Governor Says Growth May Turn Positive In Jan-March

Monetary Policy Committee has been a failure in its mission as it couldn’t provide the repo rates to the banks and also it breached its target of maintaining inflation at 4(+- 2)%.

By Neeraj Kumar

RBI Governor Shaktikanta Das is hitting every ball outside the stadium. Although the Monetary Policy Committee has been a failure in its mission as it couldn’t provide the repo rates to the banks and also it breached its target of maintaining inflation at 4(+- 2)%. The current inflation percentage stands at 6.6%, neither it was able to maintain the GDP.

But, the MPC decided to leave the policy repo rate unchanged at 4% and continue with the accommodative stance of the monetary policy as long as necessary to revive growth, mitigate the impact of COVID 19 while ensuring that inflation remains within the target. RBI Governor said that India’s GDP for FY21 is likely to contract 9.5%.

There may be a strong bounce back after the contraction according to him. Optimistically speaking he emphasized that some silver linings can already be seen. He iterated his point by displaying ready and positive stats in different areas of the economy. Das announced that to tackle and revive the economy from the vicious blows thrown by the pandemic, RBI is going to take some unconventional measures. These include:

- The initiation of real-time gross settlement (RTGS) by RBI 24x7x365.

- It also rationalized risk weightage on home loans which means all housing loan risk will be linked only to loan value.

- Ways and Means Advance(WMA) limit for the Centre was kept at Rs. 1.25 lakh crore.

- On-tap TLTRO for Rs. 1 lakh crore at 4% till March 2021 was announced.

- Besides, OMO worth Rs. 20,000 crore will be conducted next week.

- RBI will conduct special and outright bond purchases.

Indian Economy has started to move towards a crucial phase with regards to the ongoing battle against coronavirus. Keeping this in mind the RBI will keep an accommodative monetary stance for as long as needed, Das said.

RBI’s growth forecast was almost what was predicted by the forecast of World Bank, which said India’s growth will plunge by 9.6% in 2020-21. This latest projection is worse than what the multilateral agencies imagined in June. It clearly shows the horrendous impact that COVID has administered on India’s economy as the pandemic wrecked business activities and stagnated the flow of the economy. These decisions would play a pivotal role in economic revival. This pandemic has affected not just the Indian economy but the whole world has seen a slowdown and all the central banks are working to make sure that they don't go into recession in the near future.

What's Your Reaction?